Its commonly believed that counter-cyclical stocks are difficult to find because businesses usually struggle when others around them are doing poorly. However, as CLP Holdings and utilities demonstrated earlier, that is not always the case. In another article, Housel compared the return of Public Storage stock with and without dividends reinvested. An article by Morgan Housel of the Motley Fool emphasizes the importance of dividends and their substantial influence on total returns. This is why electricity stocks with high payout rates are bid up during economic uncertainty. If a business does not have adequate cash on hand or does not want to dilute the parent company’s stock, it can choose to do this.

Create a Free Account and Ask Any Financial Question

Dividend payments also influence key financial ratios, such as the dividend payout ratio and the return on equity (ROE). The dividend payout ratio, which measures the proportion of earnings distributed as dividends, provides insights into the company’s earnings retention and distribution strategy. A high payout ratio might suggest limited reinvestment in growth opportunities, while a low ratio could indicate a focus on internal growth.

Which of these is most important for your financial advisor to have?

For shareholders, the tax treatment of dividends varies depending on the jurisdiction and the type of dividend received. In many countries, qualified dividends are taxed at a lower rate compared to ordinary income, providing a tax advantage to investors. For instance, in the United States, qualified dividends are taxed at long-term capital gains rates, which are generally lower than ordinary income tax rates. This preferential treatment aims to encourage investment in dividend-paying stocks. However, not all dividends qualify for this lower rate, and investors must meet specific holding period requirements to benefit from the reduced tax rate.

How comfortable are you with investing?

For example, if a stock pays a quarterly dividend of $1 per share and the investor owns 50 shares, they would receive a dividend of $50 each quarter. A dividend payment is a portion of a company’s earnings paid out to the shareholders. For every share of stock an investor owns, they get paid an amount of the company’s profits. Dividends are a portion of the profits that a company distributes to shareholders in the form of dividends. In order to pay dividends, the company must receive a net profit, which it distributes to its shareholders. Dividends represent a critical aspect of corporate finance, serving as a means for companies to distribute profits back to shareholders.

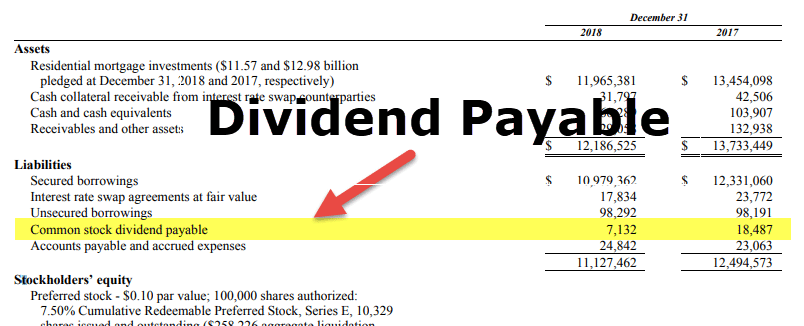

It’s using its cash to pay shareholders instead of reinvesting it into growth. After the company pays the dividend to shareholders, the dividends payable account is debited for $500,000. The cash and cash equivalent account is also reduced for the same amount through a credit entry of $500,000. When dividend account type paid, the stock dividend amount reduces retained earnings and increases the common stock account. Stock dividends do not change the asset side of the balance sheet—they merely reallocate retained earnings to common stock. The credit entry to dividends payable represents a balance sheet liability.

- A stock of Company A costs $95 per share, and a stock of Company B costs $165.

- Further, qualified dividends are usually taxed at lower rates that apply to capital gains – but there may be some variables involved that can change that.

- Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

- In addition, Telstra has 3.793 billion dollars of free cash flow which helps to reduce risk.

- In other words, it is a Balance sheet account that is considered to be a temporary bookkeeping account.

Because they often own dividend stocks, mutual funds and exchange-traded funds (ETFs) may distribute dividend payments to their shareholders. If you own an ETF or mutual fund, you’ll receive your portion of the fund’s dividend income based on the number of shares you own and the company’s representation in the fund. An S&P 500 fund, for example, might pay a dividend yield of 1.77% while some companies within the S&P 500, like Kohl’s, offer dividend yields above 13% (more on yields below). When a company decides to distribute dividends, the accounting process begins with the declaration date. On this date, the board of directors formally announces the dividend, creating a liability on the company’s balance sheet. This liability is recorded as “Dividends Payable” and represents the company’s obligation to pay its shareholders.

Dividends are one way that companies can share their profitability with their shareholders. When a company earns profits, the board of directors has the discretion to decide whether to distribute those earnings to shareholders in the form of dividends. Investors who don’t want to research and pick individual dividend stocks to invest in might be interested in dividend mutual funds and dividend exchange-traded funds (ETFs). These funds are available to a range of budgets, hold many dividend stocks within one investment and distribute dividends to investors from those holdings. Companies that can increase dividends year after year are often more attractive to investors. The dividend per share calculation shows the amount of dividends distributed by the company for each share of stock during a certain time period.

Some companies continue to make dividend payments even when their profits don’t justify the expense. A steady track record of paying dividends makes stocks more attractive to investors. For companies, the tax implications of paying dividends can also be significant. While dividends are not tax-deductible expenses, meaning they do not reduce the company’s taxable income, they can influence the company’s overall tax strategy. For example, companies may choose to retain earnings and reinvest them in the business to defer taxes, rather than distributing them as dividends. The tax treatment of dividends also varies for different types of dividends.